Weekly Outlook

Is 50 the new 25?

This last week featured the Reserve Bank of Australia (RBA) and the European Central Bank (ECB) meetings. While the ECB is undoubtedly of more importance for the global financial system, it was the message from the RBA that I think is worth noting.

The debate before the meeting was whether the RBP would hike its cash rate, then at 0.35%, by 25 bps or 40 bps. The debate centered around what RBA Gov. Lowe meant when he said after the May meeting that the RBA Was going back to a “business as usual” policy process. Some people argued that hiking by 25 bps at a time would be “business as usual.” Others argued that hiking by 40 bps and bringing the cash rate up to a standard 0.75% would be “business as usual.” Instead though the RBA hiked 50 bps to 0.85%. It would seem that according to Gov. Lowe, 50 bp hikes now qualify as “business as usual.”

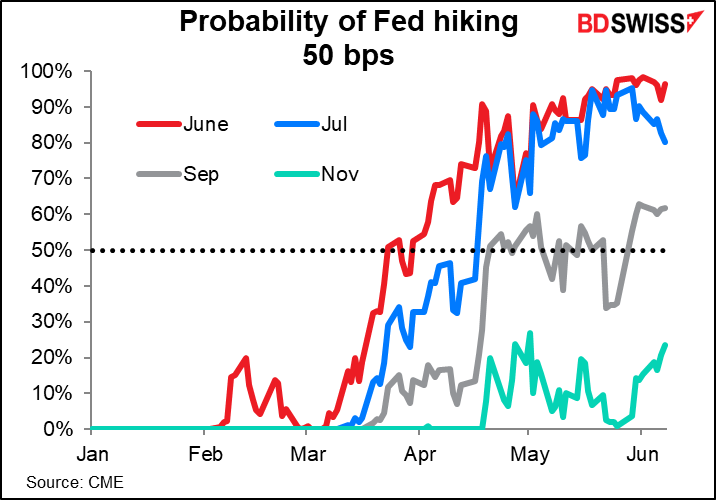

The RBA wasn’t the first of the G10 central banks to hike by 50 bps, nor will it be the last. The Reserve Bank of New Zealand (RBNZ) went first* on April 13th, with another 50 bps hike at the end of May. The US Federal Open Market Committee (FOMC), the rate-setting body of the US central bank, hiked by 50 bps at the beginning of May and it’s almost certain that it will do so again at its meeting next week and in July – probably in September and maybe even in November, too. The Bank of Canada did so on June 1st.

(*Looking at the G20, Brazil was the first, hiking by 75 bps in March 2021. We won’t discuss Turkey or Russia, two outliers.)

That may be why the ECB’s statement that it “intends to raise the key ECB interest rates by 25 basis points at its July monetary policy meeting” disappointed the market. The Governing Council did say that it expects to hike again in September and that the size of that hike “will depend on the updated medium-term inflation outlook.” “If the medium-term inflation outlook persists or deteriorates, a larger increment will be appropriate at the September meeting,” they said. So they are holding out the prospect – the likelihood, in fact — of a 50 bps hike in September, but not making any promises.

Next week: FOMC, Swiss National Bank, Bank of England, Bank of Japan

Four of the G10 central banks meet next week.

The Fed is pretty much guaranteed to hike by 50 bps, as mentioned above. The market will want to get some insight into how they see the risks going forward and whether, after Friday’s US consumer price index (CPI), they think inflation is peaking or whether it will continue to go higher. In this respect, the focus is likely to be on the new Summary of Economic Projections (SEP), containing forecasts for inflation and the fabled “dot plot” of the members’ forecasts for the fed funds rate. Their actions at this meeting are pretty well telegraphed; what’s of interest will be what they predict for the future.

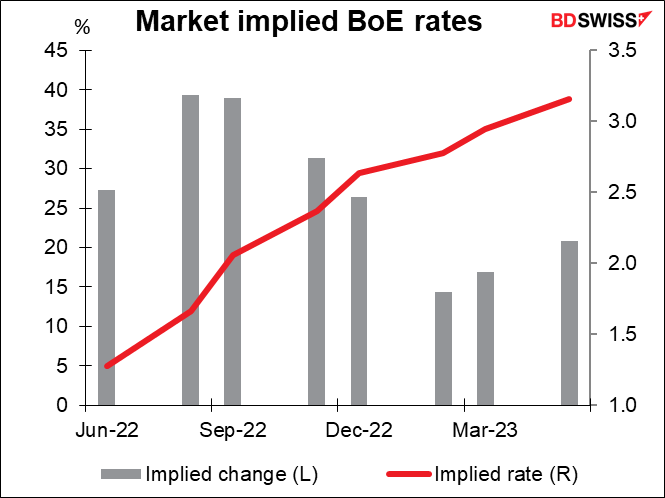

The Bank of England also seems to be a foregone conclusion for this meeting. So far there are 11 forecasts in Bloomberg and all of them are going for a 25 bps hike to 1.25%, as does the market. The market does see a good chance of a 50 bps hike at the next two meetings, though.

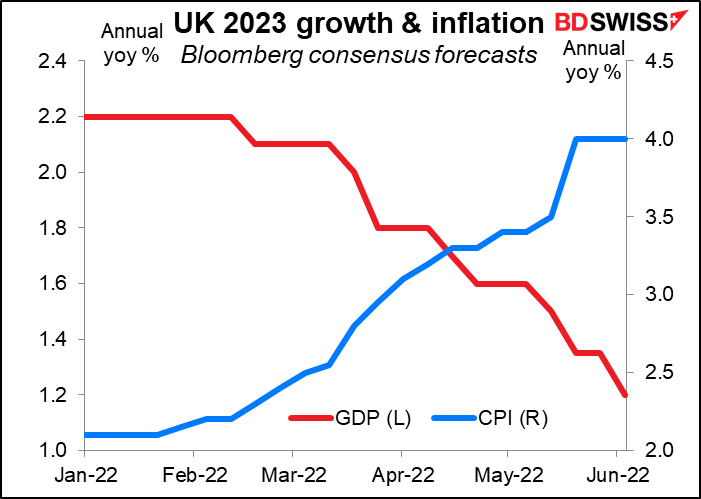

The problem facing the UK is that the outlook for the economy is dreadful. The Organization for Economic Co-Operation and Development (OECD) this week predicted that economic growth in the UK will grind to a halt next year with only Russia performing worse among the G20 leading economies. OECD Chief Economist Laurence Boone noted that the UK is unique in simultaneously grappling with high inflation, rising interest rates, and increasing taxes.

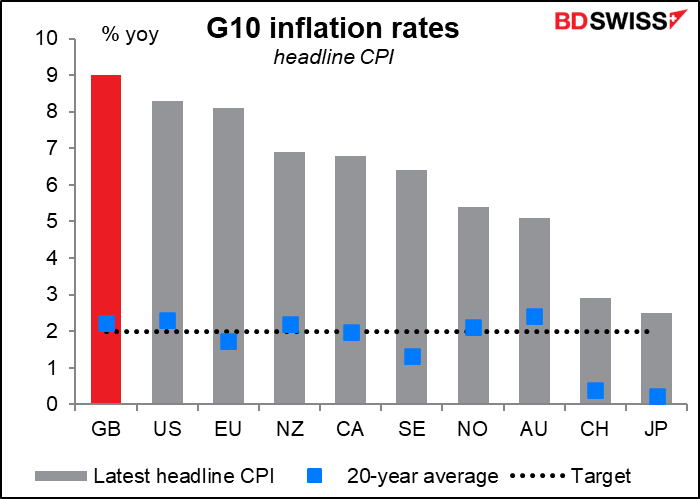

The high UK inflation – the highest in the G10 – will squeeze household and corporate incomes as will a further round of tax increases.

Against that background, the Monetary Policy Committee (MPC) has to tread a fine line between fighting inflation and kicking the already-reeling economy down the stairs. People will want to get some insight into how this debate is playing out among the members of the MPC. Last month they voted 6-3 in favor of 25 bps, with the minority wanting to hike 50 bps. How many (if any) will vote for 50 bps this time?

The BoE’s forward guidance shows a major split in views. It reads:

Based on their updated assessment of the economic outlook, most members of the Committee judge that some degree of further tightening in monetary policy may still be appropriate in the coming months. There are risks on both sides of that judgement and a range of views among these members on the balance of risks. The MPC will continue to review developments in the light of incoming data and their implications for medium-term inflation

Notice that “most” members think some further tightening will be necessary. Does that imply the existence of some members who don’t think further tightening “may be appropriate”? Or does it refer to those members who think further tightening will definitely be appropriate? Also, the balance of risks is apparently a matter of some debate.

In short, the impact of the BoE meeting will come not from what they do – that’s pretty much settled – but from what they say or imply. A sense that the hawks are in the ascendant (or even just staying hawkish) might help to boost GBP, whereas their retreat would be a green light for the market to take GBP/USD down to 1.20.

FYI, Michael Saunders, who has consistently voted for a 50 bps hike, will only participate in this meeting and the next one (August) before being replaced by Dr. Swati Dhingra, an Associate Professor at the London School of Economics. She’s a well-known critic of Brexit but I couldn’t find any record of her views on inflation or monetary policy. The departure of the MPC’s biggest hawk may mean that there are only two months left for the hawks to win a 50 bps hike, unless of course UK inflation gets even more out of hand.

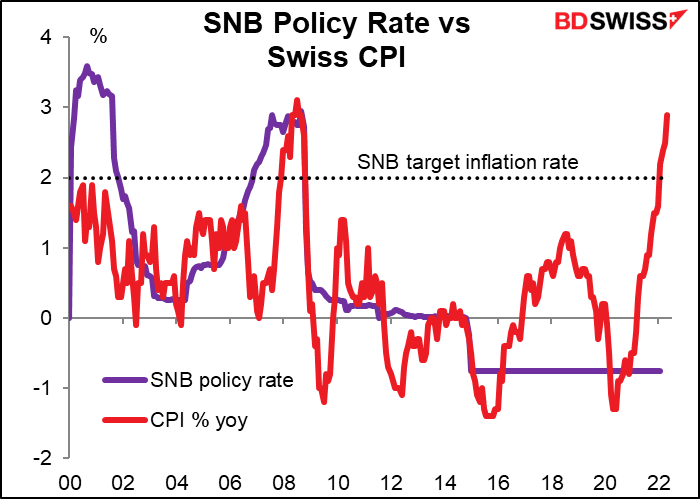

The results of the Swiss National Bank (SNB) and Bank of Japan (BoJ) meetings are not in much doubt, either. They’re both likely to do nothing, which is more or less what they’ve been doing for a long time anyway (particularly the SNB, which hasn’t changed its policy rate since 2015). Again, we’ll be more interested in what they say than what they do.

The SNB has been warning for some time that it might have to take some action to slow down inflation, which at 2.9% is at a 14-year high well above their 2% target (but not by much when compared with other countries).

People will be waiting to see what they say about CHF, inflation, and the possibility of any change, but I wouldn’t expect anything dramatic at this meeting. Probably they will just repeat their usual boilerplate phrase, which is:

(The SNB) is keeping the SNB policy rate and interest on sight deposits at the SNB at −0.75% and is willing to intervene in the foreign exchange market as necessary, in order to counter upward pressure on the Swiss franc. In so doing, it takes the overall currency situation and the inflation rate differential with other countries into consideration. The Swiss franc remains highly valued.

I wouldn’t look for any change in SNB policy until September. The September ECB meeting is on the 8th and the September SNB meeting is on the 22nd. That means the SNB will know the results of the ECB meeting and can perhaps raise rates on the ECB’s coattails.

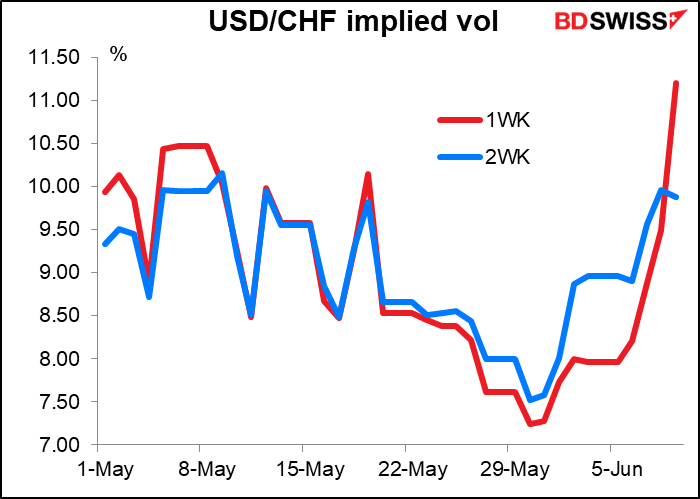

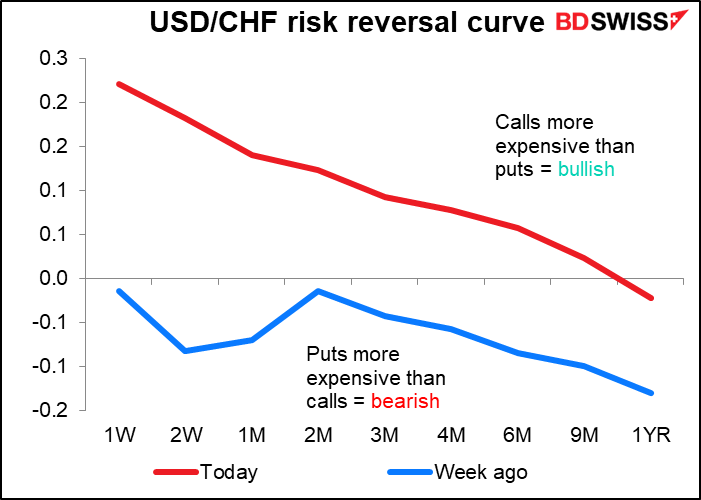

Nonetheless the options market is looking for some volatility in CHF. One- and two-week implied volatility tracked each other closely but 2wk vol went higher around June 3rd, which is when it covered the SNB meeting. Now that the one-week vol covers it, that has gone sharply higher.

The risk reversals suggest that a week ago, the market was concerned about the possibility of a hawkish SNB meeting, which is why the RR curve dipped at the two-week tenor. But now the curve out to nine months suggests the market expects further CHF weakness, implying more Fed hikes and not much SNB action.

The BoJ (Friday) is getting interesting, finally. Over the last 25 years their policy rate has barely moved by 50 bps. Can you believe that once upon a time I used to publish a daily comment on the Bank of Japan’s money market activities and wrote a monthly BoJ-Watch publication? I’m glad I found something else to do for a living.

I don’t expect them to change policy at this meeting, either. BoJ Gov. Kuroda made a speech on June 6th in which he laid out the case for continued easing. “Japan’s economy is still on its way to recovery from the pandemic and has been under downward pressure from the income side due to rising commodity prices. In this situation, monetary tightening is not at all a suitable measure,” he said. He drew a contrast between Japan’s situation and that of other countries, meaning that there’s no need for Japan to follow the global hiking trend. “Unlike other central banks, the Bank has not faced the trade-off between economic stability and price stability,” he said. He then concluded the speech by noting that “the Bank will take a strong stance on continuing with monetary easing.” Is it possible that 10 days later he changes course completely? Not likely.

However, things are heating up in Nihonbashi as they’re finding that their limited success in getting inflation up isn’t popular at all with Mrs. Watanabe. BoJ Gov. Kuroda (correctly) said in that speech that “changes have recently started to be seen in both firms’ and households’ perceptions of inflation and inflation expectations in Japan.” He then said something he shouldn’t have: “As firms adopt an increasingly active price-setting stance, Japanese households’ tolerance of price rises has been increasing.”

A tsunami of criticism of this comment forced Gov. Kuroda to make an embarrassing retraction. He said at a Diet session the next day that those words were “completely inappropriate” and that he wished to “retract” them. He added that he is fully aware “households are accepting price hikes as a painful choice” and apologized for making such “misleading” comments. He should’ve known better. In a BoJ survey done in March, 82% of the respondents said that the rise in prices was “rather unfavorable” vs only 2.9% who said it was “favorable.” So while the BoJ struggles to achieve 2% inflation, it seems that the populace kind of likes no inflation.

This groundswell of popular opposition to rising prices suggests that maybe, just maybe, some time down the road the BoJ might change its policy. But certainly not now.

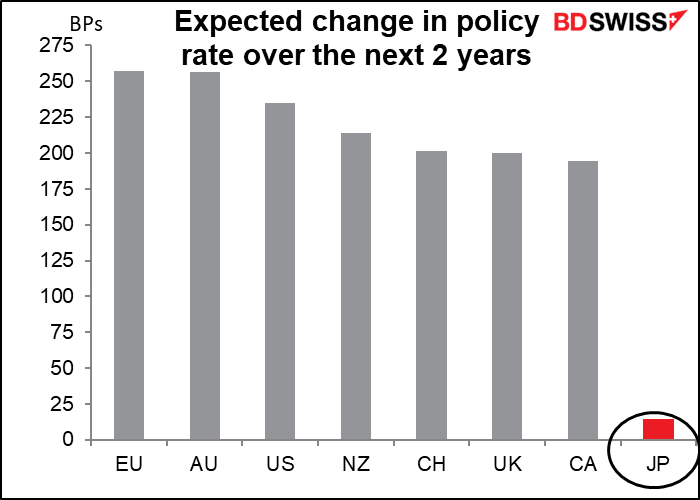

If they did change, the first thing they’d do probably is tinker with their yield curve control (YCC) policy, which says that they will keep the 10-year bond yield within ±25 bps of 0%. They could either widen the band further or lower the maturity of the relevant bond, perhaps to 5 years, which would give more room for longer-dated yields to rise. This could come as early as the October meeting, when the BoJ publishes its quarterly Outlook Report. After that they’d stop buying bonds and eventually hike interest rates. But that day is probably a long time away — at the moment, the market isn’t even pricing in one full rate hike for Japan over the next two years.

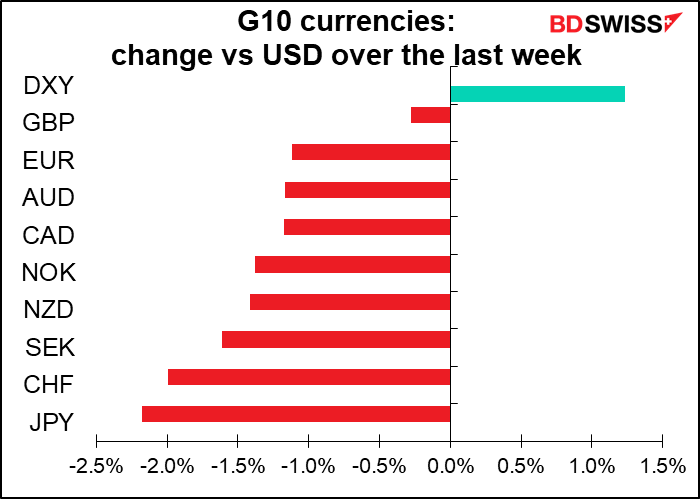

More likely we could see some measures to slow or halt the decline in the yen, first with verbal intervention and then eventually with actual market intervention. That would help to offset the upward push on prices coming from imported raw materials, which have soared in price (food and energy, particularly). We should watch out for comments by Ministry of Finance officials. But until then, I think there’s pretty much a green light for USD/JPY to move higher (JPY to weaken further).

Major indicators out during the week

This comment is long enough already so I’m not going to go into much detail on the major indicators out during the week.

For the US, the main focus will be on retail sales on Wednesday. Other key indicators are the producer price index (Tue), Empire State and Philadelphia Fed indices (Wed & Thu, respectively); housing starts (Thu), and leading index (Fri).

It’s a big week for UK indicators. Monday is “short-term indicator day,” with the monthly GDP, industrial and manufacturing production, and trade data. Employment data comes out Tuesday and retail sales on Friday. As usual, PM Johnson’s political problems and the never-ending debate over the Northern Ireland Protocol may bubble to the surface as well. But my impression is that the market takes this mishigas as background noise for Britain under the current regime and is focusing largely on monetary policy, i.e. the Bank of England meeting.

For the EU, the final German CPI (Tue) and final EU-wide CPI (Fri) will be the focus, but of course not as important as the preliminary estimate that’s already out.

New Zealand announces its Q1 GDP on Thursday.

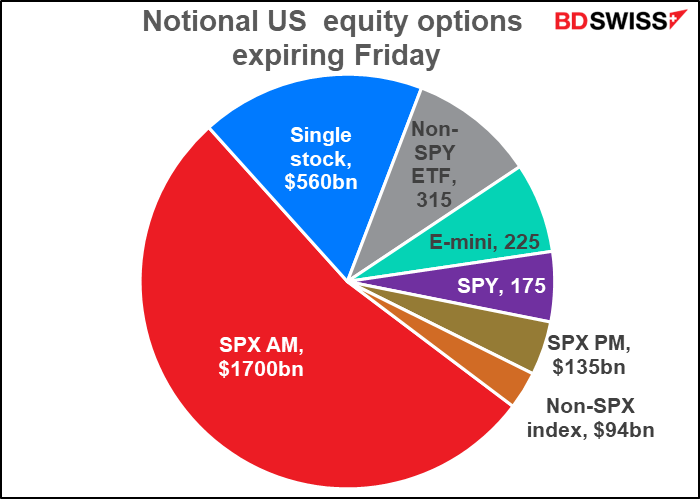

Finally, there’s a notional $3.2trn of open interest in US equity options expiring on Friday, which could boost stock market volatility.